IMPACT OF COVID-19

As Covid-19 continues its march around the world and we all do our best to socially distance and physically disrupt the spread, a grey cloud has formed over our Worlds financial economies. The impact it will have on our personal lives, our businesses, our places of worship and our futures could be life changing.

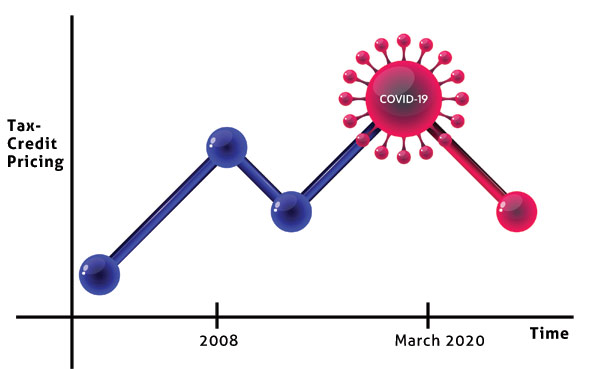

While the financial crises of 2008 does not share the same root cause as our current situation, there are certain elements you can consider that telegraph the future and will help you consider your next moves to ensure the solvency of your non-profit organization.

The use of tax-credits to redevelop HUD housing becomes wildly unpredictable and risky.

As yet, corporations have not posted their losses, but with limited revenue, there will be losses. When corporations are not posting gains, there is a large reduction in their tax-liability. When tax-liability wains, the demand for tax-credits follows. A reduction in the demand for tax-credits results in a decline of tax-credit pricing. This situation can be wildly dynamic and between 2008-12 the value of tax credits dropped significantly and negatively impacted equity proceeds for sellers. Many promises were broken and many expectations were not met by tax-credit developers as the markets shifted against their hopes and expectations. The current uncertainly in the tax-credit demand provides little assurances to a seller that the tax-credit allocation will allow the developer/ syndicator to sell the credits at their forecast pricing.

When the economy is hurting, donations to non-profit entities that rely on member or congregation funding are hugely impacted. In 2008, HPI worked with many non-profits and through preservation of their HUD assets we helped ensure the non-profit sponsors organizations and religious entities stayed solvent and their housing remained affordable.

HPI helped several entities close cash-transactions who had tried and failed to navigate a risky tax-credit transaction. We have a strong balance sheet and a great depth of HUD experience. Our funding channels are robust and we are not reliant upon the application for, or allocation of, tax-credits to close our transactions.

A preservation sale would create a large amount of equity that your organization could use to fund its long-term operations and goals. You may have not considered a preservation disposition of your HUD community until now, but consider the following regarding how a sale could benefit your organization:

- The housing will be preserved as HUD affordable housing within the Section 8 program

- There would be zero financial impact to the residents

- Your entity could receive proceeds in as little as 90 days

- HPI could offer financial assistance toward a seller’s transaction fees

- A sale would not affect any residents or on-site staff

- A sale would create a large amount of equity that your organization could use to fund long term operations, programs, missions, outreach etc.

As long-term preservation owners and operators of HUD affordable housing, we are committed to ensuring HUD properties remain within their HUD programs. Our long-range (30-40 year) focus and complimentary debt strategies allow us to continue our mission through these uncertain times. We would be happy to speak with you to discuss our experience navigating through these difficult times, and how a preservation sale would be beneficial to your organization.